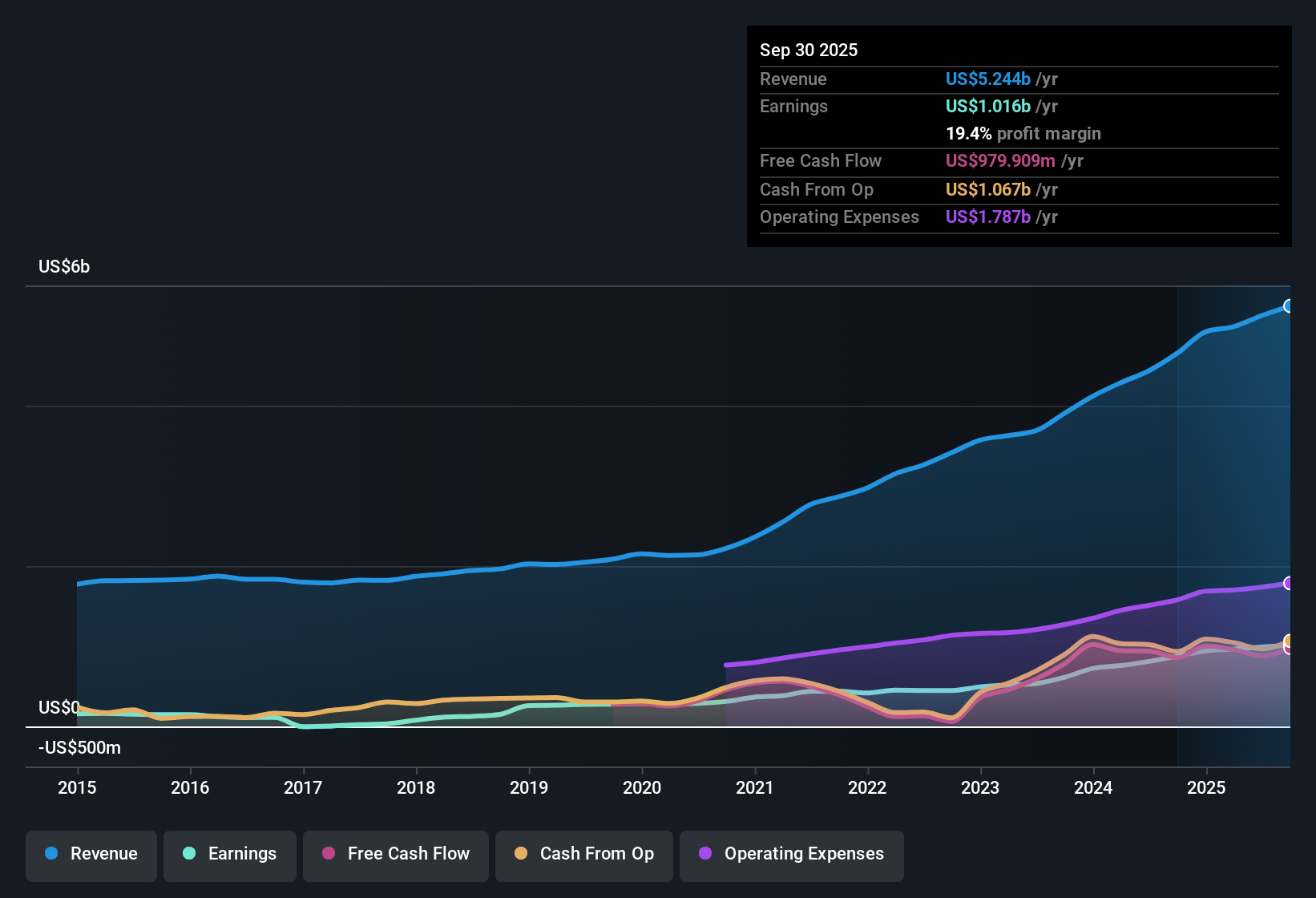

Deckers Outdoor (DECK) delivered 16% annual earnings growth last year, below its robust five-year average of 23.5%. Current net profit margins have increased to 19.4%, an improvement from 18.8% last year, highlighting consistent profitability. With Deckers trading at $81.5 per share, well below the estimated fair value of $106.42, and a better-than-peer price-to-earnings ratio of 11.7, investors view the company's combination of strong past earnings growth and improving margins as a positive sign, even if future growth forecasts remain muted compared to the broader U.S. market.

Check out our full analysis for Deckers Outdoor.

The next section examines how these results compare with the dominant narratives that shape expectations of Deckers. It highlights which market beliefs are supported and where surprises could arise.

See what the community is saying about Deckers Outdoor

Strong brands increase margins abroad

- UGG and HOKA drive revenue growth with international sales, particularly in APAC and Europe, expanding the company's reach and increasing direct sales margins.

- The consensus opinion of analysts links margin gains with

- recent brand expansion and innovative product launches that have reduced reliance on wholesale channels and driven higher margin direct sales,

- However, notes risks related to exchange rate fluctuations and supply chain disruptions that could put pressure on future margins and earnings even as brands expand globally.

The analysts' price target is 37% above the market

- The current share price of $81.50 is well below analysts' price target of $111.97, a discount that stands out from both peer valuations and broader luxury sector valuations.

- The consensus opinion of analysts suggests this

- The attractiveness of the valuation is underpinned by Deckers' robust historical earnings growth (23.5% per annum over five years).

- While continued improvements in net profit margins and significant brand strength justify a higher multiple relative to peers, supporting potential upside towards the consensus target.

Profit margins are expected to tighten

- Consensus forecasts suggest that profit margins will decline from the current 19.3% to 17.4% over the next three years, despite management's margin-enhancing initiatives.

- The consensus opinion of analysts underlines

- that future earnings growth is expected to lag the broader market (Decker's 3% versus 16.1% in the US market),

- and some forecasters warn that the removal of the Koolaburra brand and a more promotional sales environment could hurt near-term margin performance.

If you want to see the full range of perspectives driving these consensus expectations and what they mean for Deckers stock, read the full narrative breakdown for deeper insights. 📊 Read the full Deckers Outdoor Consensus story.

Next Steps

To see how these results relate to long-term growth, risk and valuation, check out the full range of Deckers Outdoor community stories on Simply Wall St. Add the company to your watchlist or portfolio to be notified as the story develops.

Do you see a new perspective in the data? Share your opinion and create your own narrative in just minutes. Do it your way

A good place to start is with our analysis, which highlights three key benefits that investors are bullish on Deckers Outdoor.

See what else is out there

While Deckers Outdoor has delivered steady profit growth and margin improvement, consensus forecasts suggest significantly slower profit expansion and margin decline, particularly compared to the broader U.S. market.

If you want to gain exposure to companies that are better positioned for reliable revenue and profit growth, check out the Stable Growth Stock Screener (2087 Results) to find companies that consistently outperform in both good and bad times.

This article from Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only an unbiased methodology and our articles are not intended as financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term focused analysis based on fundamental data. Note that our analysis may not reflect the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage all your stock portfolios in one place

We created this ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of portfolios and see your total in one currency

• Be alerted to new warning signs or risks via email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Worried about the content? Contact us directly. Alternatively, you can also send an email to editor-team@simplywallst.com