On October 29, UFP Industries (UFPI) caught investors' attention with its third-quarter results, pointing to year-over-year declines in both revenue and net income. In addition to these earnings, the company announced a 6% increase in its quarterly dividend and confirmed the completion of a large share buyback.

Check out our latest analysis for UFP Industries.

Despite the decline in quarterly sales and earnings, UFP Industries has taken steps to increase shareholder value through a higher dividend and a large share buyback. However, this was not enough to reverse a declining trend. Over the past year, the share price has fallen 17% and the total return to shareholders has fallen by almost 31%. Longer-term investors still benefit from a strong total return of 84% over five years. Recent momentum has cooled, suggesting investors are waiting for signs of renewed growth or improving sentiment.

If you're curious about what other companies are currently piquing investor interest, you should use our discovery tool to find fast-growing stocks with high insider ownership.

With UFP Industries trading at a discount to analyst targets despite weaker results, investors need to consider whether the current price represents a real value opportunity or whether the market is already pricing in future growth challenges.

Most popular narrative: 18.7% underrated

With a fair value of $113.17 and UFP Industries' most recent closing price at $92, the most followed narrative assumes significant upside potential from current levels. This perspective points to overlooked strengths, even as challenges remain.

Recent and ongoing investments in innovative, higher margin and sustainable building products such as Surestone composite decks are expected to enable UFP Industries to capitalize on growing consumer demand for environmentally friendly materials. The company aims to double its market share in composite decking and railings over the next five years, which could have a positive impact on sales and margins.

Read the full story.

Want to know what bold predictions drive this price target? The narrative points to critical changes in revenues, margins and future product mix. Discover the full upside potential behind these numbers and find out what could be the reason behind the 18.7% undervaluation.

Result: Fair Value of $113.17 (UNDERVALUED)

Read the entire narrative and understand what lies behind the predictions.

However, continued weakness in real estate demand or increasing competition could undermine recovery prospects and delay UFP Industries' expected return to stronger growth.

Find out about the main risks of this UFP Industries narrative.

Another view: Discounted cash flow challenges the upward trend

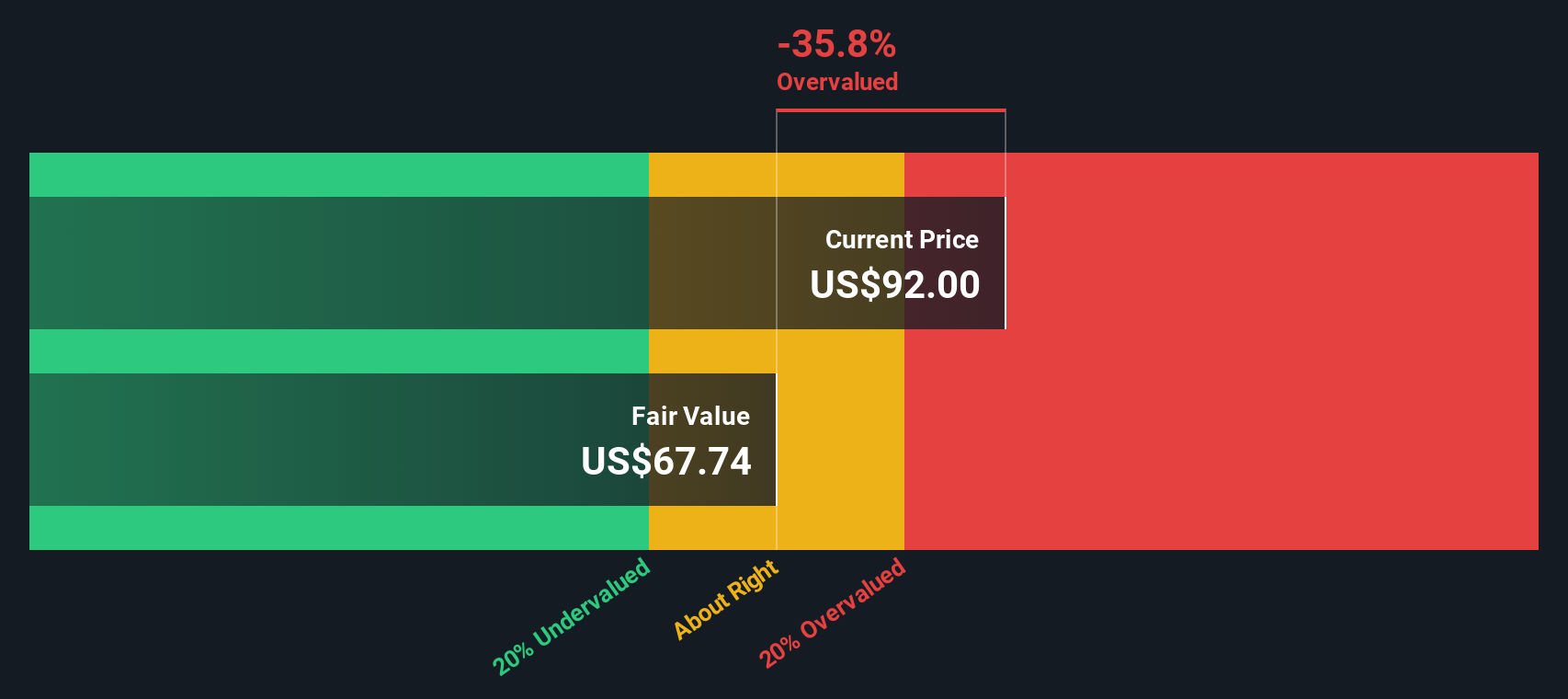

While multiples suggest UFP Industries offers good value, our SWS DCF model tells a different story. According to DCF, the stock is actually trading above its “fair value” of $68.60. If the market is right, is the DCF missing something in the company's potential or is it the other way around?

See how the SWS DCF model determines its fair value.

Simply Wall St runs a daily Discounted Cash Flow (DCF) on every stock in the world (look at UFP Industries for example). We show the entire calculation in full. You can track the outcome in your watchlist or portfolio and be notified if this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. When you save a screener, we'll even notify you when new companies match – so you never miss a potential opportunity.

Create your own UFP Industries narrative

If you want to see things differently or dig into the numbers yourself, you can quickly create a personalized narrative in just a few minutes and do it your way.

A good place to start is with our analysis, which highlights the five key benefits that investors are bullish on UFP Industries.

Ready for more smart investment ideas?

Don't settle for missing out on great opportunities. Get ahead by using the Simply Wall Street Screener to find standout stocks that match your goals in seconds.

This article from Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only an unbiased methodology and our articles are not intended as financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term focused analysis based on fundamental data. Note that our analysis may not reflect the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued small caps due to insider purchases

• High-growth technology and AI companies

Or create your own from over 50 metrics.

Explore now for free

Do you have feedback on this article? Worried about the content? Contact us directly. Alternatively, you can also send an email to editor-team@simplywallst.com