- Earlier this week, Deckers Outdoor Corporation reported strong second-quarter results with revenue increasing to $1.43 billion and net income of $268.15 million. At the same time, it announced a cautious forecast for the full year due to expected cost and demand challenges.

- Despite robust international growth at its HOKA and UGG brands, management warned that U.S. consumer caution and tariffs are likely to impact upcoming earnings.

- We'll examine how the subdued full-year outlook, driven by tariffs and demand concerns, impacts Deckers Outdoor's future investment narrative.

Trump has promised to “unlock” American oil and gas, and these 22 U.S. stocks are making moves that are expected to benefit.

Deckers Outdoor Investment narrative summary

To be a Deckers Outdoor shareholder, you must believe in long-term global growth for brands like HOKA and UGG, supported by international expansion and DTC profits. Recent results delivered strong sales and profit performance, but weaker U.S. demand and higher tariffs now pose the biggest risks, weighing heavily on the near-term outlook and investor sentiment. This news significantly impacts both near-term expectations and the company's key growth catalyst in the US.

Among recent developments, Deckers' decision to forecast fiscal 2026 revenue at around $5.35 billion, below analyst consensus, stands out as the most relevant. These lower forecasts, combined with management's warnings about U.S. consumer caution and tariff pressure, directly reinforce key risks to growth and profitability, particularly as margin headwinds increase.

In contrast, investors should be particularly vigilant about how U.S. consumer caution due to tariffs and higher prices could alter Deckers' revenue mix in the coming quarters…

Read the full report on Deckers Outdoor (free!)

Deckers Outdoor's outlook calls for sales of $6.5 billion and profits of $1.1 billion by 2028. This is based on an annual revenue growth rate of 8.5% and earnings increasing by $110 million from the current $989.7 million.

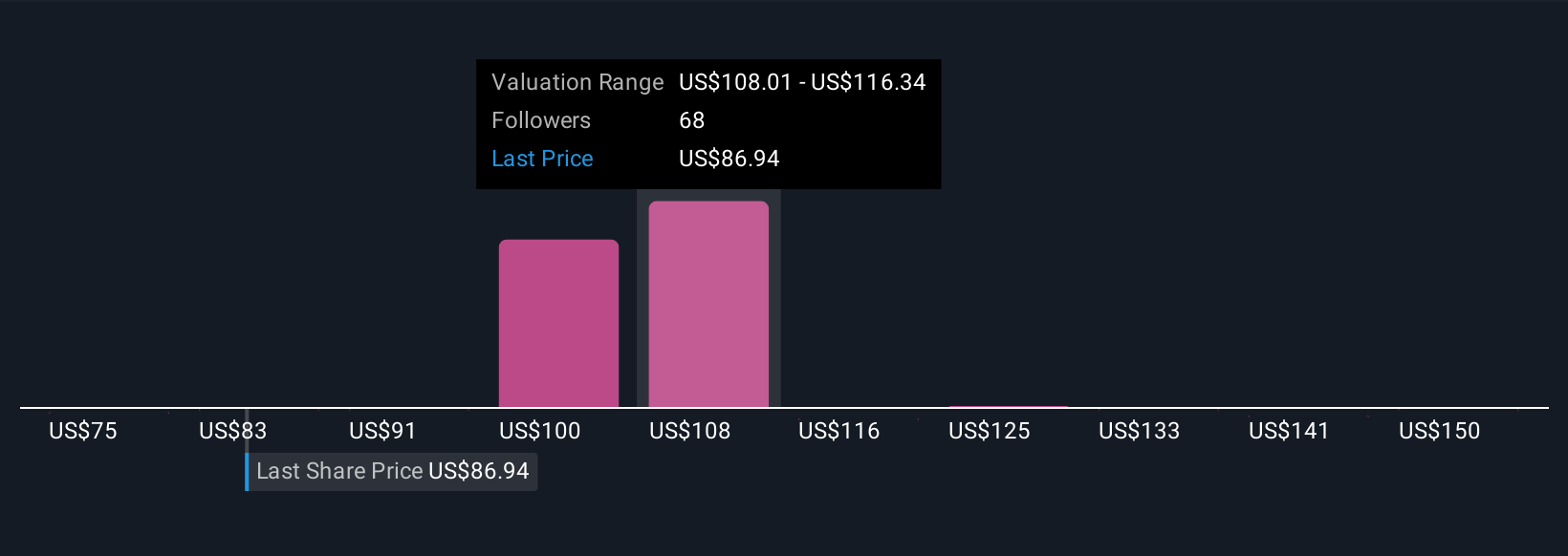

Discover how Deckers Outdoor's predictions show a fair value of $114.36, a 32% increase from the current price.

Explore other perspectives

Twenty members of the Simply Wall St community estimate Deckers' fair value at $74.68 to $158 per share. With U.S. consumer caution now coming into sharper focus, weighing these different perspectives can help you identify the true drivers of Deckers' performance.

Discover 20 more Deckers Outdoor fair value estimates – why the stock could be worth up to 82% more than the current price!

Create your own outdoor narrative from Deckers

Do you disagree with existing narratives? Create your own investment in under 3 minutes – exceptional investment returns rarely come from following the herd.

- A good starting point for your Deckers Outdoor research is our analysis, which highlights three key benefits that could impact your investment decision.

- Our free Deckers Outdoor research report provides comprehensive fundamental analysis summarized in a single image – the snowflake – making it easy to assess Deckers Outdoor's overall financial health at a glance.

Ready for a different approach?

Early risers are already taking notice. Check out the stocks they're targeting before they're delisted:

This article from Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only an unbiased methodology and our articles are not intended as financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term focused analysis based on fundamental data. Note that our analysis may not reflect the latest price-sensitive company announcements or qualitative material. Simply Wall St has no positions in any stocks mentioned.

New: Manage all your stock portfolios in one place

We created this ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of portfolios and see your total in one currency

• Be alerted to new warning signs or risks via email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Worried about the content? Contact us directly. Alternatively, you can also send an email to editor-team@simplywallst.com