At Saastr workshop Wednesday liveEthan short -wing, previously partner at Bessemer Venture Partners and now a founding partner at Chemistry VC, led us through a deep dive where Serie A Financing is available in 2025.

And register for the next free workshop on Wednesday Here.

https://www.youtube.com/watch?v=sssh-lhlof10

About Ethan Kurzweil

Ethan is the founder of Chemistry VC, a focused risk in early stages, which writes $ 3-30 million checks with an average of USD $ 10 to $ 12 for Serie A. Before the founding scheme, Ethan spent 16 years at Bessemer Venture Partners, where he led investments in successful companies such as Pagerduty, Intercom and Sendgrid. At 17 years of venture capital experience, Ethan began his career in consumer investigation before turning to B2B, where he developed special specialist knowledge in developer platforms and B2B software. Together with the partners Mark Goldberg (formerly index) and Christina Shen (formerly Bessemer and Andreessen Horowitz), Chemistry VC collected a fund of 350 million US dollars, which focused exclusively on the investment of series A.

Current status of the early phase venture market

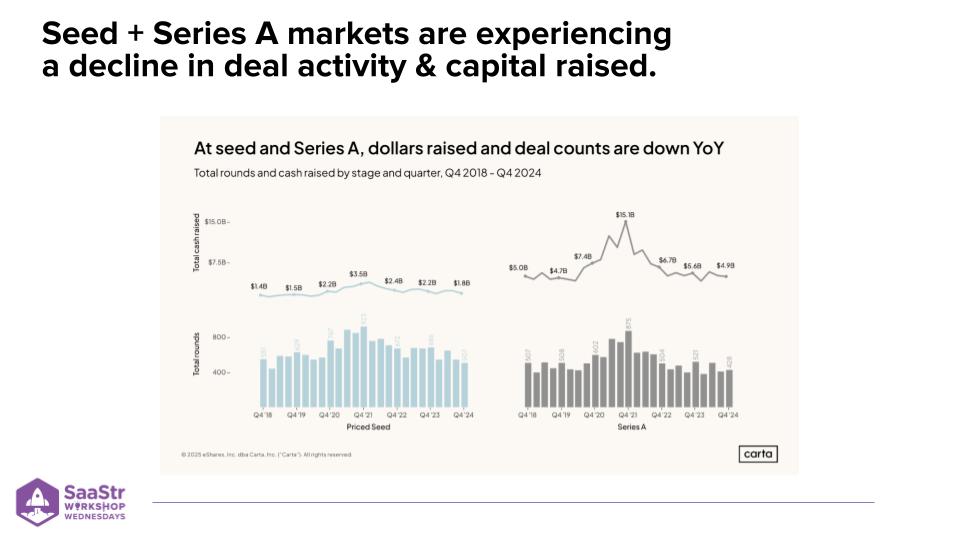

The venture landscape in early stages has had significant changes since the top of 2021. We see:

- Deal activity decline: From the highest stands of 2021 (about 3.5 Mr. in the fourth quarter of 2021) we see a return to the basic level levels, but still under the interest volumes before zero interest.

- Longer financing time plans: The series of the series -a took average from about 12 months to 25 months, with the founders for longer runway.

- More capital in fewer businesses: While the overall capital use returns to level before 2021, it focuses on fewer companies, which makes the environment more binary and competitive.

- Final rates sink: The percentage of seed companies that successfully increase series A has dropped considerably in all industries, which has created a “crunch” for many startups.

What will be financed in 2025

According to Ethan, companies that check several of these boxes receive the financing:

- Show companies persistent dynamic That probably seems to continue

- Team forward -looking topics (especially AI-related)

- Demonstrate products Clear customer demand and willingness to pay

- Startups with Raving customer reviews and strong net expansion

- Founder with Unique, convincing visions Who can articulate them effectively

The “KI Premium” remains real in 2025, whereby the evaluation premiums escalate through financing phases:

- 20% bonus at seeds

- 40% premium in series A.

- 60% premium in series B

However, Ethan warns that investors are not looking for “Ki for AI will”, but companies that apply AI to solve discrete business or consumer problems with proven traction.

Serie A success strategies for 2025

Ethan shared several critical strategies for founders who approached series A:

- Understand your “why”: Clearly articulate why you accumulate capital and what you will do with it simply “it's time for the next round”.

- Explain the moment “why now”: Connect your finance time with market dynamics, technological shifts or other factors that create urgency.

- Create a convincing story: Structure your story with a clear arc from the foundation to the current traction to future vision.

- Carry out a deliberate process: Be strategic in relation to your donation as in scatter or excessively compressed. Take your time to build relationships with potential investors.

- Concentrate on the right metrics: Be transparent about your key indicators instead of relying on vanity figures. Include critical metrics:

- Netto -Neu -Ar -Wachstum

- Netto -Dollar -Stahlung

- Gross -logo storage

- CAC repayment time

- Average contract value (ACV)

- Burn several times (ideally 1-2x for healthy growth)

Findings about the standard “Triple, Triple, Double, Double”

The classic SaaS growth scale of “Triple, Triple, Double, Double” (3x growth for two years, followed by two years for two years) was once the gold standard, but the landscape shifted:

- For many competitive AI markets, this benchmark may no longer be sufficient to attract first-class financing

- In more stable, discrete markets such as developer platforms, this growth disease can still be attractive

- The key is that growth is sustainable and is bound with real customer value, not only with the capital setting

Water trenches in the age of the AI

A fascinating exchange that was pointed out how traditional software trenches are disturbed by AI:

- Technical lock-in and switching costs decreases in the Ki era

- Users and developer love remains one of the strongest water trenches

- Products that establish real emotional connection and solve real pain points

- Free AI tools (such as Chatgpt, Claude) describe users to expect more value for less costs

- Products need stronger promises of value that go beyond mere functionality to maintain competitive edges

4 things founder may not expect the financing of Series A today

- Several seed rounds are now the norm, not the exception: Most companies will perform seed rounds in front of the A 2+ series, and investors do not see this negatively. Prepared, seeds and seeds+ rounds are conceptually summarized. As Ethan notes: “Nobody looks back and docks for more [seed rounds]. “”

- The “close process” council is potentially harmful: While conventional wisdom proposes to carry out a compressed fundraising process with artificial deadlines, Ethan uses a “intentional process” instead. For relationship-based series A financing, the time is time to really understand your business, which leads to better partnerships.

- The capital alone rarely accelerates growth curves: While the founders often believe that additional funds enable faster growth, Ethan observes that this rarely occurs, unless a company is really sub -optimized. Most companies that are just below the growth threshold cannot simply spend higher growth rates.

- The rod of the starting results continues to increase: Since the IPO threshold now effectively requires growth of 50% with sales of USD 500 million, the way to risk tunes has become more demanding. This reality is attributed to previous phases and requires the founders to build long -term sustainable companies instead of planning quick exits or market bubbles.

https://www.youtube.com/watch?v=sssh-lhlof10